During these unprecedented times, working remotely has become the new standard for many businesses. While having a virtual workplace can be beneficial, it can also expose individuals and companies to the dangers of cybercrime. In fact, cybercrime is being committed at an alarming rate during the COVID-19 pandemic, according to INTERPOL, as criminals take advantage of the security vulnerabilities being exposed in the new work-from-home environment.

Cybercrimes are committed by criminals that con their victims into sharing personal information. These criminals use various methods to trick individuals, such as spoofing tactics, intimidation, and the impersonation of trustworthy people. When people fall for these scams, criminals gain access to sensitive information and can steal an individual's identity.

Identity theft can have lasting, damaging effects on finances, medical records, and even mental health. When someone assumes another’s identity, it can ruin their reputation. Here are some ways that identity theft can cause harm:

- Insurance information may be stolen and used for medical services, leading to the policy reaching the maximum payout.

- A social security number can be used to open new credit accounts or apply for a loan, tanking the victim's credit score.

- Worse yet, crimes may be committed using a stolen identity, leaving the victim with a criminal record.

Now, more than ever, it is important to remain alert when using a computer or smartphone. According to phoenixNAP, in 2019 an organization fell victim to ransomware every 14 seconds.

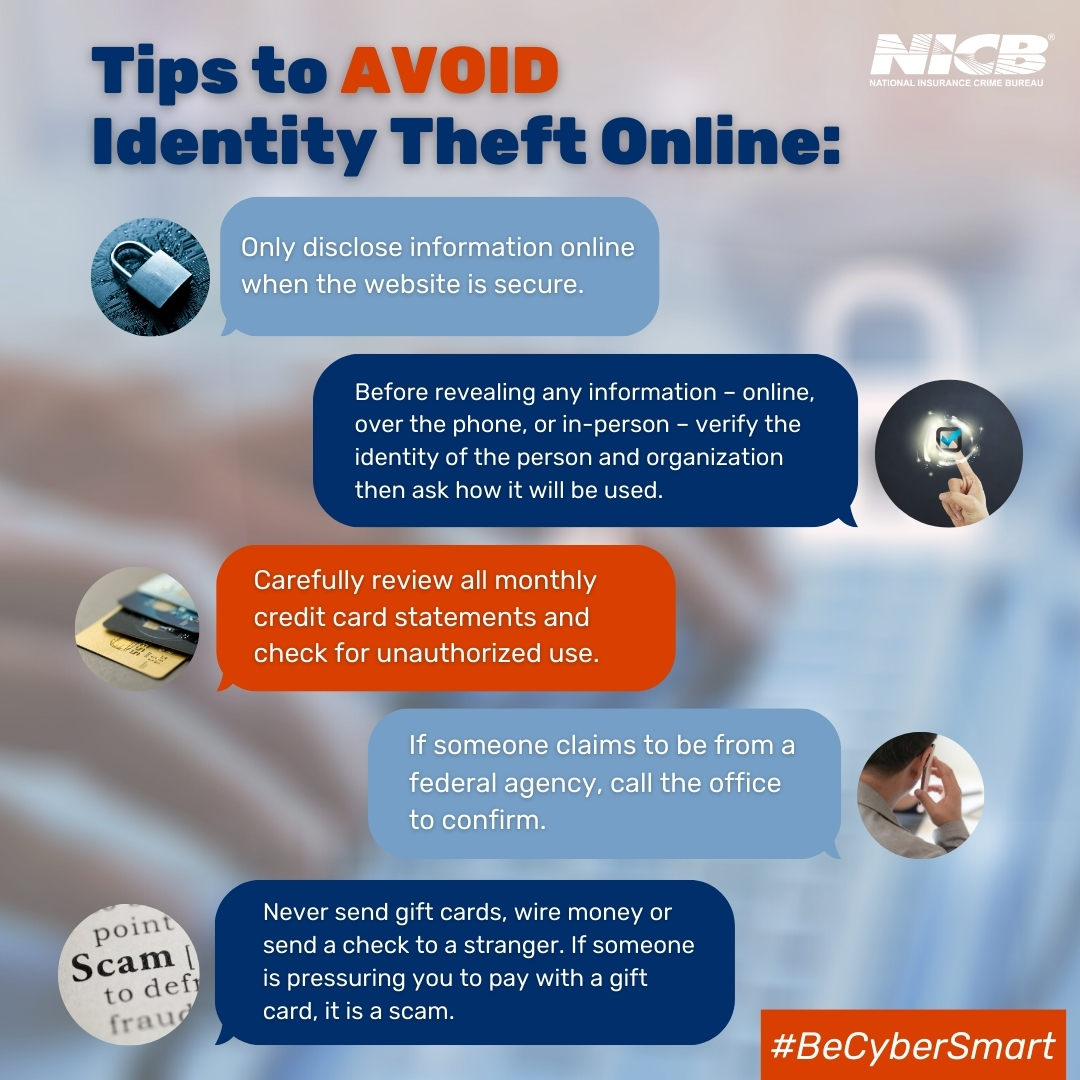

Don’t become the next victim! Use these Tips to Avoid Falling Victim to Cybercrimes:

- Shred or tear up personal financial documents before discarding them.

- Minimize the number of cards and identifying information you carry, especially your social security card and passport.

- Do not print personal identifiers and only use them when absolutely necessary; avoid writing your social security number, date of birth or driver’s license number on checks.

- Only reveal information online when the website is securely protected (look for a yellow padlock symbol in the corner of your computer screen).

- Do not provide personal, financial or any other identifying information to a telephone caller.

- Be sure to ask why they are calling, what the information will be used for and then get their name and telephone number to check and see that the caller is legitimate.

- Carefully review all monthly credit card statements and check for unauthorized use.

- Pay attention to your credit card billing cycles, as identity thieves may reroute bills to another address to hide criminal activities involving your accounts.

- Get a copy of your credit report at least once a year to check for possible errors.

During National Cybersecurity Awareness Month, the National Insurance Crime Bureau (NICB), will be sharing tips like these and more to keep our members and consumers ahead of the curve.